Annuity

Help prepare for the future with an annuity

What is an annuity?

An annuity is a financial product that can help address some common financial concerns, from helping you save for retirement and providing a level of protection for your retirement savings to helping address inflation and longevity. Allianz® annuities offer the following features and benefits:

1. Accumulation potential

Some annuities have the potential to earn interest or credits based on the growth of an external index (we call this “indexed interest”). You can choose from one or more external indexes and crediting methods, depending on your financial goals. Other types of annuities offer growth potential through variable investment options.

2. Tax-deferred growth

You don’t have to pay income taxes on the earnings in your contract until you take money out of your annuity. Tax deferral may help the money in your annuity compound over time, for even greater accumulation potential.

3. Level of protection

Annuities can help protect the money you place in your contract (the “principal”). Some annuities protect all of your principal from market downturns, while others offer greater potential in exchange for some market risk, including the risk of losing principal.

4. Retirement income

After a period of time specified by your contract, annuities provide guaranteed retirement income for as long as you live. Some annuities let you choose from a variety of income options – and some even offer the opportunity for income increases in retirement. These options may either be built in to the contract or optional and available for an additional cost.

Explore our annuities

PeakGain Group offers two types of annuities to help address your unique financial needs and retirement goals: fixed index annuities and registered index-linked annuities.

Fixed index annuities: interest potential with protection Provide potential for indexed interest Protect your principal and credited interest from market downturns

Registered index-linked annuities: accumulation potential with some protection Competitive performance potential Offer the opportunity for a level of protection from market downturns

How much should you pay for an annuity?

If an annuity is a good fit for you, the purchase amount will depend on your financial needs and goals. Annuities are a long-term contract, so it’s important to be sure you won’t need the money for other financial commitments or unexpected expenses. Your financial professional can help you determine whether an annuity makes sense as part of your overall retirement strategy, and in what amount.

How are annuities taxed?

Some common retirement-account tax rules apply to annuities – but not all of them. Let’s begin with tax deferral: Because the money you place in an annuity grows income-tax-deferred, you don’t have to pay income taxes on any interest or gains until you take money out of your contract. Any distributions from your annuity will be taxed as ordinary income. But – as with IRAs, 401(k)s, and pension plans – if you take money out of your annuity before age 59½ you’ll have to pay an extra 10% federal additional tax on top of any ordinary income tax. Please consult your tax advisor for guidance about your unique situation.

Are there required minimum distributions (RMDs) on annuities?

Nonqualified annuities (those held outside a retirement account) are not subject to RMDs beginning at RMD age. That’s because nonqualified annuities are purchased with money on which you have already paid income taxes. However, if you purchase an annuity within an Individual Retirement Account (IRA), you’ll have to take RMDs beginning at RMD age. You should also be aware that some annuity contracts require you to start distributions at a certain age (generally between 85 and 100) – so it’s important to ensure that the contract meets your long-term goals. A tax advisor can help you understand the tax implications of buying an annuity.

Do annuities tie up your money?

There are different kinds of annuities. Some give you immediate access, while others have a waiting period. Contracts that require waiting a specific period of time before you take money out are called deferred annuities. Typical deferral periods can range from three to 10 years. After the deferral period, you can annuitize the contract (this means you start receiving money through scheduled lifetime payments, or “annuitization”). Some annuities also let you take free withdrawals during the deferral period, up to specified amounts. But it’s important to understand your contract – because if you take out more money than it allows before the deferral period ends, you will likely incur a surrender or withdrawal charge and market value adjustment (MVA).

What is a market value adjustment?

A market value adjustment (MVA) is a calculation we use to adjust your annuity’s withdrawal amount. An MVA may adjust the withdrawal amount up or down, depending on the interest rate conditions when you take distribution(s) compared to those conditions when you contributed your premiums. But while the MVA can affect your withdrawal amounts, it can never cause your contract’s cash surrender value to be less than the guaranteed minimum value or greater than the accumulation value.

What are some typical criticisms of annuities?

There are a lot of questions about annuities, their purpose, and their cost. The fact is, annuities aren’t right for everyone. It’s also true that some annuities charge fees in exchange for the benefits they offer. But for people who want the opportunity to accumulate for retirement, a level of protection from market volatility, and guaranteed lifetime income, annuities can be a valuable addition to their overall financial portfolio.

Why do insurance companies sell annuities?

Annuities help protect some of your retirement assets in the same way you protect your car, your home, and your health. In each of these cases, you’re transferring away some of the risk of financial loss to an insurance company. A fixed index annuity (FIA) offers the potential to build some of your money with principal protection from market downturns. A registered index-linked annuities (RILA) offer the opportunity for a level of protection through a variety of crediting methods (which may also be called index strategies). Both FIAs and RILAs provide income payments during retirement – and tax deferral and a death benefit during the accumulation phase.

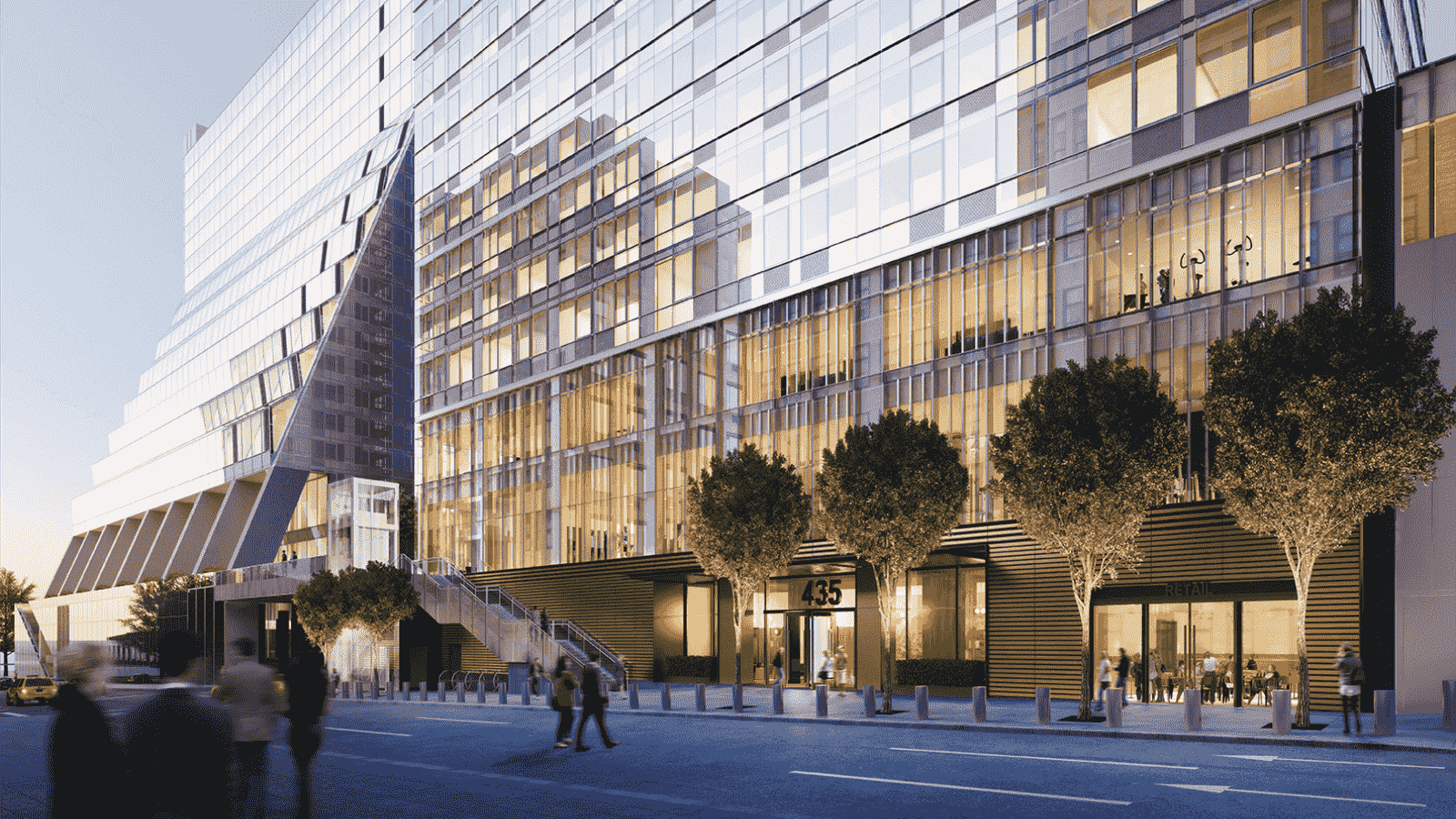

Real Estate sectors

Retail

Our high-quality retail destinations are central gathering places for the communities they

serve, combining shopping, dining, entertainment and other activities.

LOCATIONS, PREDOMINANTLY IN THE U.S

TOTAL SQUARE FEET

Our Strategies

Core/Core-Plus

Our U.S. core/core-plus real estate strategy focuses on the acquisition of assets with strong long-term cash flow potential and durable tenancy diversified across end-user industries and geographies. Ares predominately targets industrial real estate in top-tier primary and regional distribution markets with an additional focus on other major sectors including multifamily, office, necessity-based retail and other select property types across the U.S. The strategy may also include small components of our Value-Add and Opportunistic strategies as described below.Value-Add

Our U.S. and European value-add strategy focuses on undermanaged and under-funded income-producing assets, including multifamily, office, hotel, industrial, and mixed-use retail properties across the United States and Western Europe. The strategy seeks to create value and generate stable and growing distributions to investors by buying properties at attractive valuations, implementing asset management initiatives to increase income and identifying multiple exit strategies upfront.Opportunistic

Our U.S. and European opportunistic real estate strategy capitalizes on increased investor demand for developed and stabilized assets by focusing on the repositioning of asserts, capitalization of distressed and special situations, and development of core-quality assets across all major property types including multifamily, hotel, office, retail and industrial properties throughout the United States and Europe.

Targeted Investments

Real Estate Equity Strategies

Ares Management Corporation’s Real Estate Equity strategy is to focus on cash flowing quality assets and de-risked developments with an opportunity to create value through repositioning, lease-up, re-tenanting, redevelopment, and/or complex recapitalizations. Our strategy targets primary property types located in liquid markets with diversified economies where we seek to deliver compelling, risk adjusted returns through a combination of asset selectivity and disciplined portfolio management.Our Real Estate Group’s U.S. Equity platform implements real estate investment strategies that span the risk spectrum, with a footprint in 10 cities.

Across the U.S. and Europe, we believe our teams have the experience to identify property types with favorable risk adjusted returns in a given cycle, underwrite and execute these types of deals and then monetize investments delivering attractive risk-adjusted returns to investors.

Targeted Investments Characteristics

- Asset values of $10-250 million

- Attractive basis with above-average supply/demand dynamics

- Solid credit fundamentals

- Strong market position with competitive economic advantage

- Experienced, properly-incentivized sponsorship team with demonstrated track record

- Appropriately structured and documented investment

- Return opportunity that compensates for perceived risk

Value Proposition

Potential Benefits for our Investors:

-

Alignment of interests with our investors

-

Consistent, compelling performance across real estate equity and debt strategies

-

Dedicated and cycle-tested property professionals with local market experience and relationship networks

-

Complementary strategies to meet investor objectives across cycles

- Synergistic Ares platform with a well-informed global view, access to relationships and operational benefits

- Stable and growing income and/or capital appreciation from investments

- Disciplined growth with a focus on long-term value creation and capital preservation

We are taking all measures to ensure we manage to safely get through this fluid situation while continuing to serve our customers, partners, and employees effectively.